Ecommerce Guide to Ocean Freight Customs Clearance

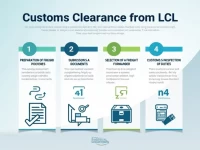

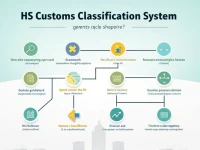

International sea freight customs clearance time is affected by factors such as cargo type, document completeness, customs inspection, and force majeure, typically taking 3-10 business days. Cross-border e-commerce sellers should ensure accurate documentation, choose a suitable freight forwarder, understand destination regulations, and declare in advance to shorten clearance times and improve logistics efficiency.